Contents

So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. A base currency is the first currency listed in a forex pair, while the second currency is called the quote currency. This leverage is great if a trader makes a winning bet because it can magnify profits. However, it can also magnify losses, even exceeding the initial amount borrowed. In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade.

The typical lot size is 100,000 units of currency, though there are micro and mini lots available for trading, too. Currencies are traded against one another as pairs (e.g., EUR/USD) and each pair is typically quoted in pips out to four decimal places. Even though they are the most liquid markets in the world, forex trades are much more volatile than regular markets.

This trading approach advises you to open and close all trades within a single day. On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Is trading in currency profitable?

Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage. Exchanging currency is not a good way for passive investors to make money.

Risks related to leverage – in volatile market conditions, leveraged trading can result in greater losses . Be especially cautious if you have acquired a large sum of cash recently and are looking for an investment vehicle. In particular, retirees with access to their retirement funds may be attractive targets for fraudulent operators.

What is the spread in forex trading?

These types of markets without centralized exchanges are called over-the-counter or OTC marketplaces. Forex traders anticipate changes in currency prices and take trading positions in currency pairs on the foreign exchange market to profit from a change in currency demand. They can execute trades for financial institutions, on behalf of clients, or as individual investors. To make profitable trades, forex traders need to be comfortable with massive amounts of data and rely on a mixture of quantitative and qualitative analysis to predict currency price movements.

Just like scalp trades, day trades rely on incremental gains throughout the day for trading. Remember that the trading limit for each lot includes margin money used for leverage. This means that the broker can provide you with capital in a predetermined ratio. For example, they may put up $100 for every $1 that you put up for trading, meaning that you will only need to use $10 from your own funds to trade currencies worth $1,000. In the United States, the National Futures Association regulates the futures market.

A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. A short position rev trader pro is ‘closed’ once the trader buys back the asset . As a forex trader, you’ll notice that the bid price is always higher than the ask price.

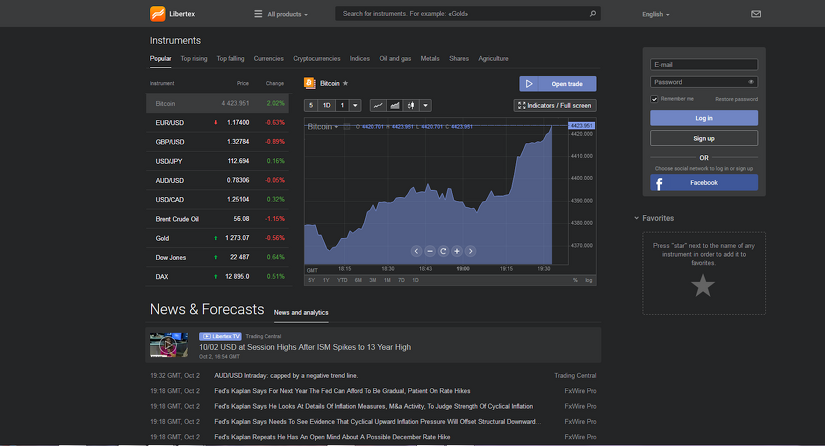

Trade Forex, Crypto CFDs, Stocks, Metals and More

For example, the Dutch Auction System of FX bidding provides a window through which the participating banks could boost their liquidity position on regular, largely, weekly basis. One way through which this is achieved is when, on weekly basis, huge float domestic currency funds accumulate in the customers’ current accounts as deposits for the FX bidding. The banks would retain and continue to utilize the funds until and pending when the amounts equivalent to the customers’ bid have been debited from their accounts with the Central bank. Thus, the rate of exchange in this market is referred to as the official exchange rate—ostensibly to distinguish it from that of the autonomous FX market.

Prices can change quickly and there is no guarantee that the execution price of your order will be at or near the quote displayed at order entry (“slippage”). Account access delays and slippage can occur at any time but are most prevalent during periods of higher volatility, at market open or close, or due to the size and type of order. Execute your forex trading strategy using the advanced thinkorswim trading platform.

Therefore, traders tend to restrict such trades to the most liquid pairs and at the busiest times of trading during the day. The blender company could have reduced this risk by short selling the euro and buying the U.S. dollar when they were at parity. That way, if the U.S. dollar rose in value, then the profits from the trade would offset the reduced profit from the sale of blenders. If the U.S. dollar fell in value, then the more favorable exchange rate would increase the profit from the sale of blenders, which offsets the losses in the trade. To accomplish this, a trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity.

How many pairs should a beginner trade?

If you're just starting out, try to focus on 5 to 10 currency pairs. This will give you a few quality opportunities each month without it becoming overwhelming.

The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose. As a leading global broker, we’re committed to providing flexible services tailored to the needs of our clients. As such, we are proud to offer the most popular trading platforms in the world – MetaTrader 4 and MetaTrader 5 . Our traders can also use the WebTrader version, which means no download is required, while the MT apps for iOS and Android allow you to trade the markets on the go, anytime and anywhere.

Number of trading opportunities

Situations, when account balance is prone to becoming negative, might take place when sudden market movements drastically affect the value of assets. The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Get $25,000 of virtual funds and prove your skills in real market conditions. When it comes to the speed we execute your trades, no expense is spared.

CFDs are leveraged products, which enable you to open a position for a just a fraction of the full value of the trade. Unlike non-leveraged products, you don’t take ownership of the asset, but take a position on whether you think the market will rise or fall in value. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad. Forex is traded by what’s known as a lot, or a standardized unit of currency.

Ready to learn about forex?

If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price – slightly below the market price. Forex, or foreign exchange, can be explained as a network of buyers and sellers, who transfer currency between each other at an agreed price. It is the means by which individuals, companies and central banks convert one currency into another – if you have ever travelled abroad, then it is likely you have made a forex transaction.

As always, the Bank is grateful for any feedback that may help us improve our services and that can be provided via our Customer Support chat. Risks related to the issuing country – the political and economic stability of a country can affect its currency strength. In general, currencies from major economies have greater liquidity and generally lower volatility than those of developing countries. In a typical case, investors may be assured of reaping tens of thousands of dollars in just a few weeks or months, with an initial investment of only $5,000. Often, the investor’s money is never actually placed in the market through a legitimate dealer, but simply diverted—stolen— for the personal benefit of the con artists.

The main functions of the market are to facilitate currency conversion, provide instruments to manage foreign exchange risk , and allow investors to speculate in the market for profit. In some countries, like Nigeria, the conduct of FX transactions in this market is guided by the wholesale Dutch auction system. Under this system, the authorized dealers bid for FX under the auspices of the Central Bank every week. The Central Bank sells FX to only the banks with the winning bids at their bid rates.

Learn More About Trading

Getting your money back once it is gone can be difficult or impossible. In 2003, the CFTC and the State of Oregon Department of Consumer and Business Services sued Orion International, Inc., and its principals in U.S. District Court for the District of Oregon for fraudulently soliciting over $40 million to participate invest in cryptocurrency in a purported forex fund. Orion, and its president Russell Cline, misappropriated virtually all the customer funds. In 2006, the Court entered fines and restitution orders against the defendants totaling almost $150 million. Cline is currently incarcerated on charges stemming from his forex scam.

Of course, such large trading volumes mean a small spread can also equate to significant losses. Forex trading is the process of speculating on currency prices to potentially make a profit. Currencies are traded in pairs, so by exchanging one currency for another, a trader is speculating on whether one currency will rise or fall in value against the other. Foreign exchange, better known as “forex,” is the largest financial market in the world. This marketplace for all the world’s currencies has many potential benefits.

Trade the most popular forex pairs like EUR/USD, GBP/USD and EUR/GBP at Plus500. Use our advanced trading tools to protect your profits and limit losses. In 2004, Gregory Blake Baldwin of Utah pleaded guilty to fraud after his firm, Sunstar Funding, accepted $228,500 from 33 investors for placement into the foreign currency market. The investors’ money was not placed in the foreign currency market but was used to pay some past investors and for personal expenses of Baldwin. So, whether you’re new to online trading or you’re an experienced investor, FXCM has customisable account types and services for all levels of retail traders.

The fiduciary services are available for the owners of Savings accounts that enjoy all the benefits of Private clients. A Savings account can be requested by any MCA clients with the planned deposits above USD 100,000. forexyard Tether is joining Ethereum as a cryptocurrency that can be deposited/withdrawn by the MCA clients directly from/to their crypto wallets. This is also the first stable coin that the Bank is offering to its clients.

John Russell is an expert in domestic and foreign markets and forex trading. He has a background in management consulting, database administration, and website planning. Today, he is the owner and lead developer of development agency JSWeb Solutions, which provides custom web design and web hosting for small businesses and professionals. You can open a live or demo account to trade on price movements of forex pairs.

Trade up today – join thousands of traders who choose a mobile-first broker. The U.S. dollar is involved in just about every major currency pair, because it is the reserve currency of the world. Is the research you’ve conducted indicating the base currency (the first-named currency in the pair) is likely to weaken or strengthen?

As currencies rise or fall in value in relation to each other, traders try to predict these changes and buy or sell accordingly. Is where participants come to buy and sell foreign currencies (e.g., foreign exchange rates, currencies, etc.). Foreign exchange trading occurs around the clock and throughout all global markets. It is the only truly continuous and nonstop trading market in the world, with participants trading day and night, weekday and weekend, and on holidays.

It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. An increasing amount of stock traders are taking interest in the currency markets because many of the forces that move the stock market also move the currency market. When the world needs more dollars, the value of the dollar increases, and when there are too many circulating the price drops. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market.

In this way, the determination of the FX rate is to a large extent left to the market forces. However, the Central Bank indirectly influences the exchange rate. It does this by fixing an amount of the FX it would supply to the market and for which the authorized dealers bid. In most cases, rates movements follow speculation on the quantity of the FX that Central Bank would likely want to offer for sale sell in market.

This website is a clone of website and its purpose is to induce individuals to reveal seed phrases to their crypto wallets. For any questions regarding the use of Tether, P2P marketplace, or other services, please contact the Dukascopy Bank’s Support team. Please beware of reduced liquidity and special trading breaks for CFD’s and Bullion on Monday 4th of July 2022 due to Independence Day celebrations in the US. Please note that when trading Forex or shares CFDs you do not actually own the underlying instrument, but are rather trading on their anticipated price change. Apply for an account in a few minutes, practice trading with our FREE unlimited Demo Account until you’re ready to move to the next level. Be skeptical about unsolicited phone calls offering investments, especially those from out-of-state salespersons or companies that are unfamiliar.

The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world. The blender costs $100 to manufacture, and the U.S. firm plans to sell it for €150—which is competitive with other blenders that were made in Europe.